As parents, the responsibility of teaching our own children about the importance of financial literacy rests on our shoulders. We have a role to play in shaping their futures when it comes to finances.

Here, I'd like to share you this infographic consists of useful financial tips for parents and children from www.moneymax.ph.

10 Money Principles Kids Should Learn

1. Financial Freedom

is your choice! Choose to grow up financially free.

2. Creating Financial

Freedom is a matter of developing the right habits. Develop and establish

financial habits early on in life.

3. Pay yourself

first. Put your money to work for you to get and stay wealthy.

4. It is better to

tell your money where to go than ask where it went. Know where your money

is going and plan how much you spend and save each month.

5. Assets feed you,

liabilities eat you. Remember that assets put money in your pocket and

liabilities take money out of your pocket.

6. Don't put all your

financial eggs in one basket. Invest wisely in three pillars of wealth:

stock market, real estate, and business.

7. Save early, save

often. It's not compound interest but compound growth effect of investing

that helps people get rich and become financially free.

8. It's not how much

money you make that's important. It's about learning to better manage and

invest money that you already have.

9. Money is a tool to

reach your dreams. Money is not the end result, but it is the tool to help

you build financial freedom and security.ongoing cash flow and have more money

coming in that going out.

10. Make money grow

by putting it to work for you. Invest and put your money to work for you to

produce ongoing cash flow and have more money coming in than going out.

Helping our kids with financial cautiousness goes beyond putting some money away in a piggy bank. They need to plunge into the real adult world of money. Our kids must understand the value of money and how to manage it. They need to know how to earn, run a business and save for the future.

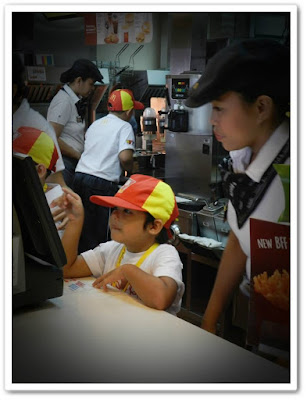

Allowing our kids to join activities that will help them replicate what happens in our adult lives will greatly help in teaching them to manage their money prudently.

|

| McDo Kiddie Crew provides on-the-floor Training |

|

| Kidzania Manila provides role-play activities |

|

| KidZerve You sold Turon and Gulaman during the Area Pastoral Gathering |

Above all, we should remember that God owns it all and we are just stewards of it. If we acknowledge this, it will change how we look at money and possessions.

To the LORD your God belong the heavens, even the highest heavens, the earth and everything in it. (Deuteronomy 10:14 NIV)

I'm looking forward for other activites related to finances where I can involve my child. If you have a good suggestion, feel free to comment below. TIA.

Agree, I also teach my son to save his money if he wants to buy something. I let my son deposit his money (from piggy bank) in his savings account.

ReplyDeleteThat's nice Mommy Michi. :)

DeleteI can't teach my kids yet about money because they're only 3and 5 years of age.. When do you think is the right time that I can teach my kids about money? :) Thanks!

ReplyDeleteHi Mommy Nicole, the earlier, the better. I've read that you can teach as soon as they're old enough to know not to put it in their mouth — you know your child better than anyone, so you know when you can start. :)

DeleteJust recently, I started teaching my son to save money, I made a little coinbank for him using his old johnson and johnson's baby powder. Lol! He loves it!

ReplyDeleteWe did that too! Recycling and saving! :)

DeleteAdmittedly, my 9-year-old son still has a lot to learn about money. I'll let him see this infographic, and hopefully he'll learn a lot and apply those learnings in real life. -- Maria Teresa Figuerres

ReplyDeleteThat's great Mommy Tetcha!

DeleteI find myself nodding to every single tip here. Money Max is always spot on! I still have a lot to teach Yuri but I'm confident that we'll get there.

ReplyDeleteI agree Mommy Marie.

DeleteAssets feed you, liabilities eat you --- hayyy so true in my life!it was a lesson hard learned but a lesson learned anyway. that's why I prepare my kids for the future and teach them how to be wise about their money.

ReplyDeleteThumbs up Mommy May! :)

DeleteMy daughter started working for her dad around age 10. She is a whiz when it comes to computers so she makes her dad's PPP. Then some of our friends heard about it so now she has some PPP clients already.

ReplyDeleteWow! That's cool.

Delete"Yes, they get tired, they experience hardships and difficulties but that's how life is. We need not to shield them against it. Instead, we need them to be prepared for the future." I super love this and this is inspiring.

ReplyDeleteThank you Mommy LadyAnne.

DeleteI may say I have taught our boys to value money and save. My first born would give to me his savings (from his school allowance) so I could deposit them in his bank. Second son would sell paper, tin cans and the like. He seldom ask money to buy things he needs as he has his own savings. I just hope they would continue to give importance to saving money.

ReplyDeleteI'm sure they will Mommy Berlin. :)

DeleteI like the last about letting money work for you. I have yet to instill the value to my kids. I hope I can teach them well.

ReplyDeleteAll the best Mommy Cheanne!

DeleteI definitely agree in teaching kids how to save and invest. I think the best will always be to become good examples for our kids.

ReplyDeleteThat's true Mommy D. Our examples is the best teacher. :)

DeleteI hope my kids will know how to save too. I learned the hard way from my mom because I am a hard headed daughter! Ha Ha Ha

ReplyDeleteI'm sure you can pass it on to the kambal, just be intentional to them! Hope to see the bulilits soon.

DeleteI agree, kids should learn these basic principles as early as possible.

ReplyDeleteThat's true Mommy Rowena. ;)

DeleteSame here, as early as 2.5 I am teaching him the value of money and how to save. And be conscious in the price that he wants to buy

ReplyDeleteAs early as possible kids should learn these principles. Also I think by setting an example it also helps them to see the positive ways of being financially independent.

ReplyDelete